Page 11 - 2015 Advia CU Benefits & Notices

P. 11

Advia CU - MI 2015

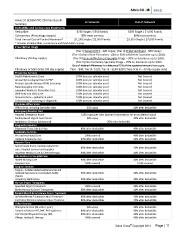

Advia CU BCBSM PPO 250 Plan Benefit In Network Out-of-Network

Summary

Deductible and Coinsurance Maximums

Deductible $250 Single / $500 Family $500 Single / $1,000 Family

Coinsurance (Percentage copays) 80% most services 60% most services

Total Annual Out-of-Pocket Maximum* $1,250 Single / $2,500 Family $3,500 Single / $7,000 Family

* Includes all deductible, co-insurance and fixed dollar co-pays.

Prescription Drugs

(Tier I) Generic/OTC - $20 copay; (Tier II) Preferred Brand - $60 copay;

(Tier III) Brand Non-Formulary - $80 or 50% whichever is greater up to $100;

Pharmacy (30 day supply) (Tier IV) Generic/Preferred Specialty Drugs – 20% co-insurance up to $200;

(Tier V) Non-formulary Specialty Drugs – 25% co-insurance up to $300

Out-of-Network Pharmacy is reimbursed 75% of the approved amount less copay.

Pharmacy or Mail Order (90 day supply) Tier I - $40; Tier II - $120; Tier III - $160-$200 (Tiers IV & V – 30 day supply only)

Preventive Services

Health Maintenance Exam 100% (one per calendar year) Not Covered

Annual Gynecological Exam & PAP 100% (one per calendar year) Not Covered

Prostate Specific Antigen (PSA) Screening 100% (one per calendar year) Not Covered

Mammography Screening 100% (one per calendar year) Not Covered

Expanded Women’s Preventive Care 100% (one per calendar year) Not Covered

Well-Baby and Child Care 100% (one per calendar year) Not Covered

Immunizations – pediatric & adult 100% (one per calendar year) Not Covered

Colonoscopy – screening or diagnostic 100% (one per calendar year) Not Covered

Physician Office Visits

Office visits, including Specialist visits $20 copay 40% after deductible

Emergency Medical Care

Hospital Emergency Room $150 copay per visits (waived if admitted or for an accidental injury)

Facility Based Urgent Care Center $20 copay 40% after deductible

Ambulance Services (air/ground) 20% after deductible

Diagnostic Services

Diagnostic Tests, Lab & X-Ray 80% after deductible 40% after deductible

Maternity Services

Pre and Post-natal Care 100% covered 40% after deductible

Delivery & Nursery Care 80% after deductible 40% after deductible

Hospital Care

Semi-Private Room, Inpatient physician 80% after deductible 40% after deductible

care, Hospital services and supplies

Inpatient Medical Care & Chemotherapy 80% after deductible 40% after deductible

Alternatives to Hospital Care

Skilled Nursing Care 80% after deductible 40% after deductible

Hospice Care 100% covered 100% covered

Surgical Services

Surgery – includes related surgical services and 80% after deductible 40% after deductible

medically necessary in or out-patient facility

charges

Voluntary Sterilization 80% after deductible 40% after deductible

Human Organ Transplants

Specified Organ Transplants 100% covered 40% after deductible

Bone Marrow & Other Transplants 80% after deductible 40% after deductible

Mental Health & Substance Abuse Treatment

In Patient Mental & Substance Abuse Treatment 80% after deductible 40% after deductible

Out Patient Mental & Substance Abuse Treatment 80% after deductible 40% after deductible

Other Services

Chiropractic Care (24 visits / year) $20 copay 40% after deductible

Outpatient Diabetes MT, DME, P&O appliances 80% after deductible 40% after deductible

O/P Occ/SP/Physical Therapy (60) 80% after deductible 40% after deductible

Allergy Testing & Therapy 100% covered 40% after deductible

Salus Group© Copyright 2014 Page | 11

Advia CU BCBSM PPO 250 Plan Benefit In Network Out-of-Network

Summary

Deductible and Coinsurance Maximums

Deductible $250 Single / $500 Family $500 Single / $1,000 Family

Coinsurance (Percentage copays) 80% most services 60% most services

Total Annual Out-of-Pocket Maximum* $1,250 Single / $2,500 Family $3,500 Single / $7,000 Family

* Includes all deductible, co-insurance and fixed dollar co-pays.

Prescription Drugs

(Tier I) Generic/OTC - $20 copay; (Tier II) Preferred Brand - $60 copay;

(Tier III) Brand Non-Formulary - $80 or 50% whichever is greater up to $100;

Pharmacy (30 day supply) (Tier IV) Generic/Preferred Specialty Drugs – 20% co-insurance up to $200;

(Tier V) Non-formulary Specialty Drugs – 25% co-insurance up to $300

Out-of-Network Pharmacy is reimbursed 75% of the approved amount less copay.

Pharmacy or Mail Order (90 day supply) Tier I - $40; Tier II - $120; Tier III - $160-$200 (Tiers IV & V – 30 day supply only)

Preventive Services

Health Maintenance Exam 100% (one per calendar year) Not Covered

Annual Gynecological Exam & PAP 100% (one per calendar year) Not Covered

Prostate Specific Antigen (PSA) Screening 100% (one per calendar year) Not Covered

Mammography Screening 100% (one per calendar year) Not Covered

Expanded Women’s Preventive Care 100% (one per calendar year) Not Covered

Well-Baby and Child Care 100% (one per calendar year) Not Covered

Immunizations – pediatric & adult 100% (one per calendar year) Not Covered

Colonoscopy – screening or diagnostic 100% (one per calendar year) Not Covered

Physician Office Visits

Office visits, including Specialist visits $20 copay 40% after deductible

Emergency Medical Care

Hospital Emergency Room $150 copay per visits (waived if admitted or for an accidental injury)

Facility Based Urgent Care Center $20 copay 40% after deductible

Ambulance Services (air/ground) 20% after deductible

Diagnostic Services

Diagnostic Tests, Lab & X-Ray 80% after deductible 40% after deductible

Maternity Services

Pre and Post-natal Care 100% covered 40% after deductible

Delivery & Nursery Care 80% after deductible 40% after deductible

Hospital Care

Semi-Private Room, Inpatient physician 80% after deductible 40% after deductible

care, Hospital services and supplies

Inpatient Medical Care & Chemotherapy 80% after deductible 40% after deductible

Alternatives to Hospital Care

Skilled Nursing Care 80% after deductible 40% after deductible

Hospice Care 100% covered 100% covered

Surgical Services

Surgery – includes related surgical services and 80% after deductible 40% after deductible

medically necessary in or out-patient facility

charges

Voluntary Sterilization 80% after deductible 40% after deductible

Human Organ Transplants

Specified Organ Transplants 100% covered 40% after deductible

Bone Marrow & Other Transplants 80% after deductible 40% after deductible

Mental Health & Substance Abuse Treatment

In Patient Mental & Substance Abuse Treatment 80% after deductible 40% after deductible

Out Patient Mental & Substance Abuse Treatment 80% after deductible 40% after deductible

Other Services

Chiropractic Care (24 visits / year) $20 copay 40% after deductible

Outpatient Diabetes MT, DME, P&O appliances 80% after deductible 40% after deductible

O/P Occ/SP/Physical Therapy (60) 80% after deductible 40% after deductible

Allergy Testing & Therapy 100% covered 40% after deductible

Salus Group© Copyright 2014 Page | 11