Page 19 - August-2020-Issue

P. 19

ARTICLE

Challenges & Opportunities

for Steel Industry under

COVID-19 Pandemic

Sushim Banerjee

DG, INSDAG

Prologue industrial and service sectors Industry Impact

Writing on the growth and pros- would be captured adequately in Table-1 takes a look at the indus-

pects of any commodity specifi- the national Accounts data for Q1 try indicators in March’20 and in

cally that of steel under the cur- and Q2 in FY21. FY20 to highlight the impact of

rent unprecedented crisis that has COVID-19 on steel consumption.

engulfed nearly all the regions of

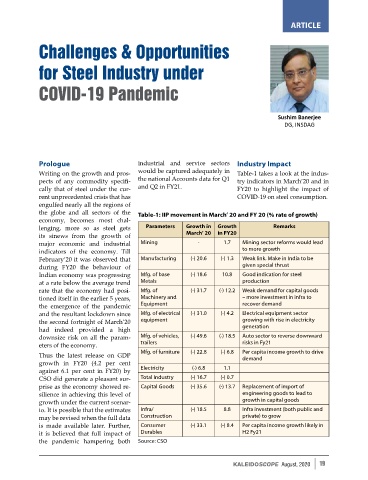

the globe and all sectors of the Table-1: IIP movement in March’ 20 and FY 20 (% rate of growth)

economy, becomes most chal-

lenging, more so as steel gets Parameters Growth in Growth Remarks

its sinews from the growth of March’ 20 in FY20

major economic and industrial Mining - 1.7 Mining sector reforms would lead

indicators of the economy. Till to more growth

February’20 it was observed that Manufacturing (-) 20.6 (-) 1.3 Weak link. Make in India to be

during FY20 the behaviour of given special thrust

Indian economy was progressing Mfg. of base (-) 18.6 10.8 Good indication for steel

at a rate below the average trend Metals production

rate that the economy had posi- Mfg. of (-) 31.7 (-) 12.2 Weak demand for capital goods

tioned itself in the earlier 5 years, Machinery and – more investment in infra to

the emergence of the pandemic Equipment recover demand

and the resultant lockdown since Mfg. of electrical (-) 31.0 (-) 4.2 Electrical equipment sector

the second fortnight of March’20 equipment growing with rise in electricity

had indeed provided a high generation

downsize risk on all the param- Mfg. of vehicles, (-) 49.6 (-) 18.5 Auto sector to reverse downward

eters of the economy. trailers risks in Fy21

Thus the latest release on GDP Mfg. of furniture (-) 22.8 (-) 6.8 Per capita income growth to drive

demand

growth in FY20 (4.2 per cent

against 6.1 per cent in FY20) by Electricity (-) 6.8 1.1

CSO did generate a pleasant sur- Total Industry (-) 16.7 (-) 0.7

prise as the economy showed re- Capital Goods (-) 35.6 (-) 13.7 Replacement of import of

silience in achieving this level of engineering goods to lead to

growth under the current scenar- growth in capital goods

io. It is possible that the estimates Infra/ (-) 18.5 8.8 Infra investment (both public and

may be revised when the full data Construction private) to grow

is made available later. Further, Consumer (-) 33.1 (-) 8.4 Per capita income growth likely in

it is believed that full impact of Durables H2 Fy21

the pandemic hampering both Source: CSO

KaleidOscope August, 2020 19