Page 160 - Caribbean-Central America Profile 2018

P. 160

BELIZE

CARIBBEAN-CENTRAL AMERICA PROFILE 2018

Duty exemptions available to investors in a • CFZ businesses incurring a net loss over The Offshore Banking Act enables licensed

CFZ: the 10 year tax holiday may deduct the loss banks and other related businesses to operate

• Merchandise, articles or other goods against profits in the 3 years following the from within Belize in foreign currencies,

entering a CFZ for commercial purpose. tax holiday period. securities and assets owned by persons not

• Fuel and goods including building materials, resident in Belize.

furniture, equipment, supplies and parts INTERNATIONAL BUSINESS This Act provides the following benefits:

required for the proper functioning of the • Offshore Banking License remains valid for

CFZ business. COMPANIES (IBC) OFFSHORE an unlimited period of time.

• Exemption from income tax, capital tax, BANKING • Entitled to establish, maintain and operate a

The Belize International Business Companies

gains tax or any new corporate tax levied by business office in Belize. Unrestricted “A”

the Government of Belize during the first 10 Act is both modern and attractive and designed Class Offshore Banking License.

years of operation. to meet the needs of sophisticated international • Restricted “B” Class Offshore Banking

• Exemption from such tax for the first 25 investors. License.

years of operation on dividends paid by a Benefits of IBC’s in Belize include: • Class “A” license allowed to transact offshore

CFZ business. • Exemption from taxes on all income. banking business without restriction.

• Imports or exports by a CFZ business do not • Exemption from taxes on all dividends. • Complete confidentiality regarding

require an import or export license. • Exemption from taxes on all interests, rent, information relating to the affairs of a

• No restrictions on the sale of foreign royalties, compensations and other amounts. licensee or any customer of a licensee.

currency or transfer of foreign exchange in • Exemption from taxes on profits and

a CFZ. • Exemption from taxes on capital gains on dividends.

• No Government charges and taxes imposed shares, debt obligations or other securities • Exemption from currency and exchange

on the use of foreign currency in a CFZ. of an IBC by non-residents. control restrictions or regulations.

• CFZ businesses are allowed to open an • No currency restrictions. International Business Companies Registry

account in any currency with any registered • Meetings of shareholders and/or directors Marina Towers, Suite 201

bank. may be held in any country and may be Newtown Barracks,

• Income tax deductions on the chargeable attended by proxy. Belize City, Belize

Tel: (501) 223-5108

income of every developer and CFZ • No citizenship or residency requirements Fax: (501) 223-5124

business after the first 10 years of operation. for directors, officers or shareholders. E-mail: info@ibcbelize.com

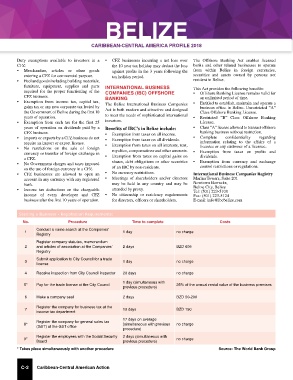

Starting a Business - Registration Requirements:

No. Procedure Time to complete Costs

Conduct a name search at the Companies’

1 1 day no charge

Registry

Register company statutes, memorandum

2 and articles of association at the Companies’ 2 days BZD 609

Registry

Submit application to City Council for a trade

3 1 day no charge

license

4 Receive inspection from City Council inspector 20 days no charge

1 day (simultaneous with

5* Pay for the trade license at the City Council 25% of the annual rental value of the business premises

previous procedure)

6 Make a company seal 2 days BZD 50-200

Register the company for business tax at the

7 10 days BZD 150

income tax department

17 days on average

Register the company for general sales tax

8* (simultaneous with previous no charge

(GST) at the GST office

procedure)

Register the employees with the Social Security 2 days (simultaneous with

9* no charge

Board previous procedure)

* Takes place simultaneously with another procedure Source: The World Bank Group

C-2 Caribbean-Central American Action