Page 47 - Caribbean-Central America Profile 2018

P. 47

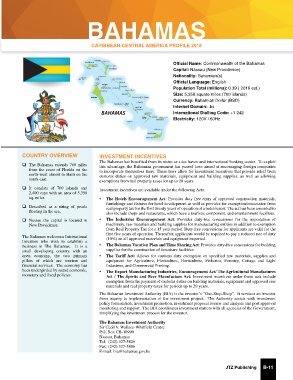

BAHAMAS

CARIBBEAN-CENTRAL AMERICA PROFILE 2018

Official Name: Commonwealth of the Bahamas

Capital: Nassau (New Providence)

Nationality: Bahamian(s)

Official Language: English

Population Total (millions): 0.39 ( 2016 est.)

Size: 5,358 square miles (700 islands)

Currency: Bahamian Dollar (BSD)

Internet Domain: .bs

BAHAMAS International Dialling Code: +1 242

Electricity: 120V / 60Hz

COUNTRY OVERVIEW INVESTMENT INCENTIVES

The Bahamas has benefited from its status as a tax haven and international banking center. To exploit

q The Bahamas extends 760 miles this advantage, the Bahamian government has passed laws aimed at encouraging foreign companies

from the coast of Florida on the to incorporate themselves there. These laws allow for investment incentives that provide relief from

north-west almost to Haiti on the customs duties on approved raw materials, equipment and building supplies, as well as allowing

south-east. exemptions from real property taxes for up to 20 years.

q It consists of 700 islands and Investment incentives are available under the following Acts:

2,400 cays with an area of 5,358

sq. miles. • The Hotels Encouragement Act: Provides duty free entry of approved construction materials,

furnishings and fixtures for hotel development as well as provides for exemption/concession from

q Described as a string of pearls real property tax for the first twenty years of operation of a hotel/resort. The act has been amended to

floating in the sea. also include shops and restaurants, which have a touristic component, and entertainment facilities.

q Nassau the capital is located in • The Industries Encouragement Act: Provides duty-free concessions for the importation of

New Providence. machinery, raw materials and building supplies for manufacturing entities in addition to exemption

from Real Property Tax for a 15 year period. Duty free concessions for applicants are valid for the

first five years of operation. Thereafter, applicants would be required to pay a reduced rate of duty

The Bahamas welcomes International (10%) on all approved materials and equipment imported.

Investors who wish to establish a

business in The Bahamas. It is a • The Bahamas Vacation Plan and Time Sharing Act: Provides duty-free concessions for building

small developing country with an supplies for the construction of timeshare facilities.

open economy, the two primary • The Tariff Act: Allows for customs duty exemption on specified raw materials, supplies and

pillars of which are tourism and equipment for Agriculture, Floriculture, Horticulture, Fisheries, Forestry, Cottage and Light

financial services. The economy has Industries, and Commercial Printing.

been undergirded by sound economic, • The Export Manufacturing Industries, Encouragement Act/ The Agricultural Manufactures

monetary and fiscal policies. Act / The Spirits and Beer Manufacture Act: Investment incentives under these acts include

exemption from the payment of customs duties on building materials, equipment and approved raw

materials and real property taxes for periods up to 20 years.

The Bahamas Investment Authority (BIA) is the investor’s “One-Stop-Shop”. It services an investor

from inquiry to implementation of the investment project. The Authority assists with investment

policy formulation, investment promotion, investment proposal review and analysis and post approval

monitoring and support. The BIA coordinates investment matters with all agencies of the Government,

simplifying the investment process for the investor.

The Bahamas Investment Authority

Sir Cecil V. Wallace-Whitfield Centre

P.O. Box CB-10990

Nassau, Bahamas

Tel: (242) 327-5826

Fax: (242) 327-5806

E-mail: bia@bahamas.gov.bs

JTZ Publishing B-11