Page 268 - MANUAL OF SOP

P. 268

Determination of Non Injurious Price

Injury Margin by comparing the NIP with the Landed Value of the dumped imports

for application of lesser duty rule.

OPERATING PRACTICES

9.5 The methodology to be followed for determination of NIP are detailed

in Annexure-III of the AD Rules. The applicable Generally Accepted Accounting

Principles (“GAAP”), Accounting Standards and Cost Accounting Standards are

also kept in mind while finalizing the NIP.

9.6 The NIP is required for initiation of investigation, which is based on the

information provided in the application. However, subsequently during the course

of investigation, the NIP workings are examined in detail after due verification

before finalising the investigations.

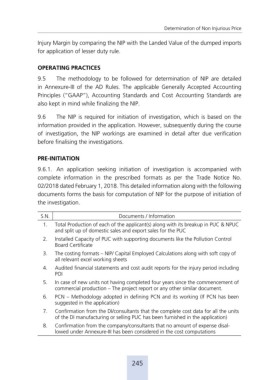

PRE-INITIATION

9.6.1. An application seeking initiation of investigation is accompanied with

complete information in the prescribed formats as per the Trade Notice No.

02/2018 dated February 1, 2018. This detailed information along with the following

documents forms the basis for computation of NIP for the purpose of initiation of

the investigation.

S.N. Documents / Information

1. Total Production of each of the applicant(s) along with its breakup in PUC & NPUC

and split up of domestic sales and export sales for the PUC

2. Installed Capacity of PUC with supporting documents like the Pollution Control

Board Certificate

3. The costing formats – NIP/ Capital Employed Calculations along with soft copy of

all relevant excel working sheets

4. Audited financial statements and cost audit reports for the injury period including

POI

5. In case of new units not having completed four years since the commencement of

commercial production – The project report or any other similar document.

6. PCN – Methodology adopted in defining PCN and its working (If PCN has been

suggested in the application)

7. Confirmation from the DI/consultants that the complete cost data for all the units

of the DI manufacturing or selling PUC has been furnished in the application)

8. Confirmation from the company/consultants that no amount of expense disal-

lowed under Annexure-III has been considered in the cost computations

245