Page 282 - MANUAL OF SOP

P. 282

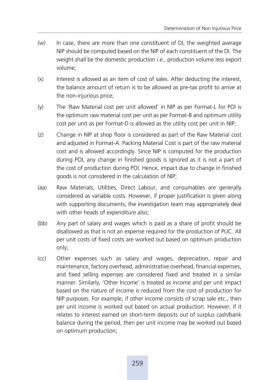

Determination of Non Injurious Price

(w) In case, there are more than one constituent of DI, the weighted average

NIP should be computed based on the NIP of each constituent of the DI. The

weight shall be the domestic production i.e., production volume less export

volume;

(x) Interest is allowed as an item of cost of sales. After deducting the interest,

the balance amount of return is to be allowed as pre-tax profit to arrive at

the non-injurious price;

(y) The ‘Raw Material cost per unit allowed’ in NIP as per Format-L for POI is

the optimum raw material cost per unit as per Format-B and optimum utility

cost per unit as per Format-D is allowed as the utility cost per unit in NIP;

(z) Change in NIP at shop floor is considered as part of the Raw Material cost

and adjusted in Format-A. Packing Material Cost is part of the raw material

cost and is allowed accordingly. Since NIP is computed for the production

during POI, any change in finished goods is ignored as it is not a part of

the cost of production during POI. Hence, impact due to change in finished

goods is not considered in the calculation of NIP;

(aa) Raw Materials, Utilities, Direct Labour, and consumables are generally

considered as variable costs. However, if proper justification is given along

with supporting documents, the investigation team may appropriately deal

with other heads of expenditure also;

(bb) Any part of salary and wages which is paid as a share of profit should be

disallowed as that is not an expense required for the production of PUC. All

per unit costs of fixed costs are worked out based on optimum production

only;

(cc) Other expenses such as salary and wages, depreciation, repair and

maintenance, factory overhead, administrative overhead, financial expenses,

and fixed selling expenses are considered fixed and treated in a similar

manner. Similarly, ‘Other Income’ is treated as income and per unit impact

based on the nature of income is reduced from the cost of production for

NIP purposes. For example, if other income consists of scrap sale etc., then

per unit income is worked out based on actual production. However, if it

relates to interest earned on short-term deposits out of surplus cash/bank

balance during the period, then per unit income may be worked out based

on optimum production;

259