Page 29 - CCFA Journal - 11th Issue

P. 29

加中金融 金融监管 Regulation

For Group 2 cryptoassets, specifically those classified as Group 2(a), only the Standardized Approach (SA) or a simplified version of

SA can be used for calculating market risk. These cryptoassets are assigned to a new risk class that is distinct from the existing risk

classes for traditional assets.

When calculating market risk for Group 2(a) cryptoassets, the sensitivities for each cryptoasset in different markets or exchanges

cannot be offset. This means that these sensitivities are calculated separately as long and short gross consolidated sensitivities.

The SA approach, or its simplified version, allows for the assessment of market risk associated with Group 2(a) cryptoassets by

considering the specific sensitivities and exposures of each individual cryptoasset. This approach acknowledges the unique

characteristics and risks of these cryptoassets and treats them as a separate risk class for regulatory purposes.

对于 Group 2 加密资产,特别是被归类为 Group 2(a)的资产,只能使用标准化方法(SA)或 SA 的简化版本来计算市场风险。

这些加密资产被分配到一个新的风险类别中,与传统资产的现有风险类别不同。

在计算 Group 2(a)加密资产的市场风险时,不同市场或交易所中的每个加密资产的敏感性不能抵消。这意味着这些敏感性

需要单独计算,包括多头和空头的总体敏感性。

SA 方法或其简化版本允许通过考虑每个个体加密资产的特定敏感性和敞口,评估与 Group 2(a)加密资产相关的市场风险。

该方法承认了这些加密资产的独特特征和风险,并将它们作为单独的风险类别进行监管。

The delta sensitivity measurement for a qualified Group 2(a) cryptoasset is determined by adjusting the spot price of the

cryptoasset by 1 percentage point, or 0.01 in relative terms. This adjustment is applied to calculate the resulting change in the

market value of the instrument, denoted as Vi.

To calculate the sensitivity, the change in market value (Vi) is divided by 0.01 (or 1%) to determine the impact of a 1% change in the

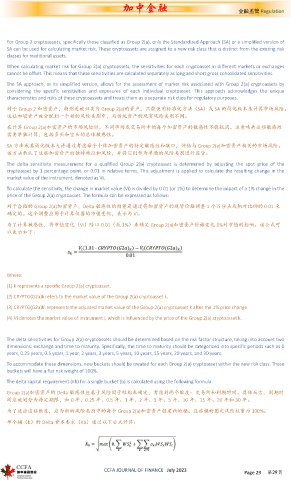

price of the Group 2(a) cryptoasset. The formula can be expressed as follows:

对于合格的 Group 2(a)加密资产,Delta 敏感性的测量是通过将加密资产的现货价格调整 1 个百分点或相对比例的 0.01 来

确定的。这个调整应用于计算仪器的市值变化,表示为 Vi。

为了计算敏感性,将市值变化(Vi)除以 0.01(或 1%)来确定 Group 2(a)加密资产价格变化 1%对市值的影响。该公式可

以表示如下:

Where:

(1) k represents a specific Group 2(a) cryptoasset.

(2) CRYPTO(G2a)k refers to the market value of the Group 2(a) cryptoasset k.

(3) CRYPTO(G2a)k' represents the adjusted market value of the Group 2(a) cryptoasset k after the 1% price change.

(4) Vi denotes the market value of instrument i, which is influenced by the price of the Group 2(a) cryptoasset k.

The delta sensitivities for Group 2(a) cryptoassets should be determined based on the risk factor structure, taking into account two

dimensions: exchange and time to maturity. Specifically, the time to maturity should be categorized into specific periods such as 0

years, 0.25 years, 0.5 years, 1 year, 2 years, 3 years, 5 years, 10 years, 15 years, 20 years, and 30 years.

To accommodate these dimensions, new buckets should be created for each Group 2(a) cryptoasset within the new risk class. These

buckets will have a flat risk weight of 100%.

The delta capital requirement (Kb) for a single bucket (b) is calculated using the following formula:

Group 2(a)加密资产的 Delta 敏感性应基于风险因子结构来确定,考虑到两个维度:交易所和到期时间。具体而言,到期时

间应被划分为特定期限,如 0 年、0.25 年、0.5 年、1 年、2 年、3 年、5 年、10 年、15 年、20 年和 30 年。

为了适应这些维度,应为新的风险类别中的每个 Group 2(a)加密资产创建新的桶。这些桶的固定风险权重为 100%。

单个桶(b)的 Delta 资本要求(Kb)通过以下公式计算:

CCFA JOURNAL OF FINANCE July 2023 Page 29 第29页