Page 180 - Practice Set Akuntansi Perusahaan Dagang - Kelas XI SMK/MAK

P. 180

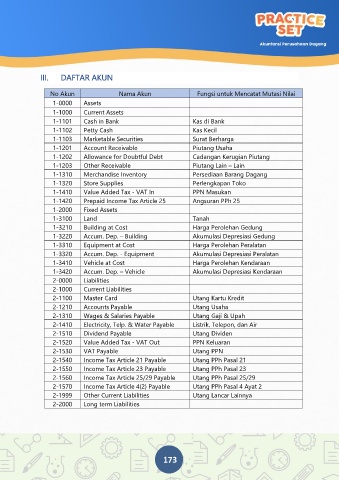

III. DAFTAR AKUN

No Akun Nama Akun Fungsi untuk Mencatat Mutasi Nilai

1-0000 Assets

1-1000 Current Assets

1-1101 Cash in Bank Kas di Bank

1-1102 Petty Cash Kas Kecil

1-1103 Marketable Securities Surat Berharga

1-1201 Account Receivable Piutang Usaha

1-1202 Allowance for Doubtful Debt Cadangan Kerugian Piutang

1-1203 Other Receivable Piutang Lain – Lain

1-1310 Merchandise Inventory Persediaan Barang Dagang

1-1320 Store Supplies Perlengkapan Toko

1-1410 Value Added Tax - VAT In PPN Masukan

1-1420 Prepaid Income Tax Article 25 Angsuran PPh 25

1-2000 Fixed Assets

1-3100 Land Tanah

1-3210 Building at Cost Harga Perolehan Gedung

1-3220 Accum. Dep. – Building Akumulasi Depresiasi Gedung

1-3310 Equipment at Cost Harga Perolehan Peralatan

1-3320 Accum. Dep. - Equipment Akumulasi Depresiasi Peralatan

1-3410 Vehicle at Cost Harga Perolehan Kendaraan

1-3420 Accum. Dep. – Vehicle Akumulasi Depresiasi Kendaraan

2-0000 Liabilities

2-1000 Current Liabilities

2-1100 Master Card Utang Kartu Kredit

2-1210 Accounts Payable Utang Usaha

2-1310 Wages & Salaries Payable Utang Gaji & Upah

2-1410 Electricity, Telp. & Water Payable Listrik, Telepon, dan Air

2-1510 Dividend Payable Utang Dividen

2-1520 Value Added Tax - VAT Out PPN Keluaran

2-1530 VAT Payable Utang PPN

2-1540 Income Tax Article 21 Payable Utang PPh Pasal 21

2-1550 Income Tax Article 23 Payable Utang PPh Pasal 23

2-1560 Income Tax Article 25/29 Payable Utang PPh Pasal 25/29

2-1570 Income Tax Article 4(2) Payable Utang PPh Pasal 4 Ayat 2

2-1999 Other Current Liabilities Utang Lancar Lainnya

2-2000 Long term Liabilities

173