Page 8 - RBL_ebook

P. 8

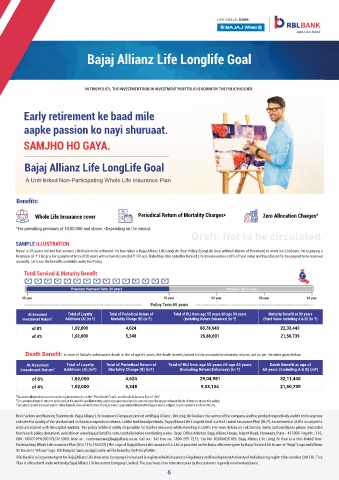

Bajaj Allianz Life Longlife Goal

IN THIS POLICY, THE INVESTMENT RISK IN INVESTMENT PORTFOLIO IS BORNE BY THE POLICYHOLDER.

Early retirement ke baad mile

aapke passion ko nayi shuruaat.

SAMJHO HO GAYA.

Bajaj Allianz Life LongLife Goal

A Unit-linked Non-Participating Whole Life Insurance Plan

Benefits:

Whole Life Insurance cover Periodical Return of Mortality Charges* 0 Zero Allocation Charges^

^For prevailing premium of 10,00,000 and above. *Depending on the variant.

Draft. Not to be circulated.

SAMPLE ILLUSTRATION

Rahul is 35 years old and has various LifeGoals to be achieved. He has taken a Bajaj Allianz Life LongLife Goal Policy (LongLife Goal without Waiver of Premium) to meet his LifeGoals. He is paying a

Premium of ` 1 lac p.a. for a payment term of 20 years with a Sum Assured of ` 10 Lacs. Rahul has also opted for Retired Life Income option at 8% of fund value and has chosen for the payout to be received

annually. Let’s see the benefits available under the Policy.

Total Survival & Maturity Benefit

Premium Payment Term 20 years Retired Life Income

35 year 55 year 65 year 85 year 99 year

Policy Term 65 years

At Assumed Total of Loyalty Total of Periodical Return of Total of RLI from age 55 years till age 99 years Maturity Benefit at 99 years

Investment Return 3 Additions (A) (in `) Mortality Charge (B) (in `) (Including Return Enhancer) (in `) (Fund Value including A & B) (in `)

of 8% 1,02,000 4,624 88,78,543 22,33,443

Premium Payment Term 20 years Retired Life Income

of 4% 1,02,000 5,348 26,86,891 21,50,739

35 year 55 year 65 year 85 year 99 year

Policy Term 65 years

Death Benefit: In case of Rahul’s unfortunate death at the of age 65 years, the death benefit, based on the assumed investment returns, are as per the table given below.

At Assumed Total of Loyalty Total of Periodical Return of Total of RLI from age 55 years till age 65 years Death Benefit at age of

Investment Return 3 Additions (A) (in`) Mortality Charge (B) (in`) (Including Return Enhancer) (in `) 65 years (Including A & B) (in`)

of 8% 1,02,000 4,624 29,04,981 32,11,445

of 4% 1,02,000 5,348 9,53,134 21,50,739

The above illustrations are considering investment is in the "Pure Stock Fund II and Goods & Service Tax of 18%"

3

The assumed rate of returns indicated at 4% and 8% are illustrative and not guaranteed and do not indicate the upper or lower limits of returns under the policy.

The sum assured amount and/or other benefit amount indicated, if any, is a non-guaranteed illustrative figure and is subject to policy terms and conditions.

Risk Factors and Warning Statements: Bajaj Allianz Life Insurance Company Limited and Bajaj Allianz Life LongLife Goal are the names of the company and the product respectively and do not in any way

indicate the quality of the product and its future prospects or returns. Unlike traditional products, Bajaj Allianz Life LongLife Goal is a Unit Linked Insurance Plan (ULIP). Investment in ULIPs is subject to

risks associated with the capital markets. The policy holder is solely responsible for his/her decisions while investing in ULIPs. For more details on risk factors, terms and conditions please read sales

brochure & policy document, available on www.bajajallianzlife.com, carefully before concluding a sale. Regd. Office Address: Bajaj Allianz House, Airport Road, Yerawada, Pune - 411006. Reg.No.: 116.

CIN : U66010PN2001PLC015959. Mail us : customercare@bajajallianz.co.in. Call on : Toll free no. 1800 209 7272. Fax No: 02066026789. Bajaj Allianz Life LongLife Goal is a Unit-linked Non-

Participating Whole Life Insurance Plan (UIN:116L156V02) | The Logo of Bajaj Allianz Life Insurance Co. Ltd. is provided on the basis of license given by Bajaj Finserv Ltd. to use its “Bajaj” Logo and Allianz

SE to use its “Allianz” logo. All charges/ taxes, as applicable, will be borne by the Policyholder.

RBL Bank is a Corporate Agent for Bajaj Allianz Life Insurance Company Limited and is registered with Insurance Regulatory and Development Authority of India bearing registration number CA0116. This

Plan is offered and underwritten by Bajaj Allianz Life Insurance Company Limited. The purchase of an insurance plan by the customer is purely on voluntary basis.

6