Page 15 - 2017 INVESTMENT PHILOSOPHY - May 2017

P. 15

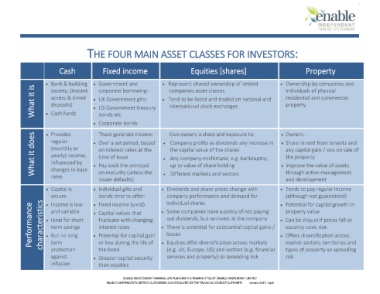

THE FOUR MAIN ASSET CLASSES FOR INVESTORS:

Equities [shares]

Fixed income

Cash • Government and • Represent shared ownership of limited • Ownership by companies and

Property

• Bank & building

What it is society, (instant • UK Government gilts • Tend to be listed and traded on national and individuals of physical

companies asset classes

corporate borrowing:-

access & timed

residential and commercial

property

deposits)

international stock exchanges

• US Government treasury

• Cash funds

bonds etc

• Corporate bonds Give owners a share and exposure to: • Owners:

What it does regular • Over a set period, based • Company profits as dividends any increase in • Share in rent from tenants and

• Provides

These generate income:

(monthly or

on interest rates at the

the capital value of the shares

any capital gain / loss on sale of

yearly) income,

time of issue

the property

• Any company misfortune, e.g. bankruptcy,

influenced by

up to value of share holding

• Improve the value of assets

• Pay back the principal

changes in base

rates on maturity (unless the • Different markets and sectors through active management

issuer defaults) and development

• Capital is • Individual gilts and • Dividends and share prices change with • Tends to pay regular income

(although not guaranteed)

bonds tend to offer:

secure • Fixed income (yield) company performance and demand for • Potential for capital growth in

Performance characteristics • Ideal for short • Capital values that • Some companies have a policy of not paying • Can be illiquid if prices fall or

individual shares

• Income is low

and variable

property value

out dividends, but re-invest in the company

fluctuate with changing

term savings

vacancy rates rise

• There is potential for substantial capital gains /

interest rates

losses

• But no long

• Potential for capital gain

• Offers diversification across

term

or loss during the life of

(e.g. UK, Europe, US) and sectors (e.g. financial

types of property so spreading

the bond

protection

against • Greater capital security • Equities offer diversification across markets market sectors, territories and

services and property) so spreading risk

risk

inflation than equities

ENABLE INDEPENDENT FINANCIAL LIFE PLANNERS IS A TRADING STYLE OF ENABLE INDEPENDENT LIMITED

ENABLE INDEPENDENT LIMITED IS AUTHORISED AND REGULATED BY THE FINANCIAL CONDUCT AUTHORITY. Version 2017 - April