Page 30 - P6 Slide Taxation - Lecture Day 3 - VAT Part 1

P. 30

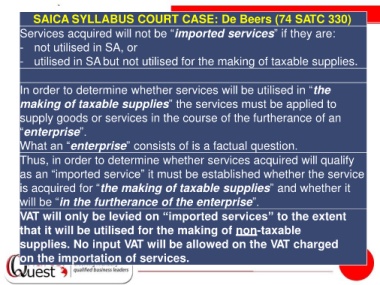

SAICA SYLLABUS COURT CASE: De Beers (74 SATC 330)

Services acquired will not be “imported services” if they are:

- not utilised in SA, or

- utilised in SA but not utilised for the making of taxable supplies.

In order to determine whether services will be utilised in “the

making of taxable supplies” the services must be applied to

supply goods or services in the course of the furtherance of an

“enterprise”.

What an “enterprise” consists of is a factual question.

Thus, in order to determine whether services acquired will qualify

as an “imported service” it must be established whether the service

is acquired for “the making of taxable supplies” and whether it

will be “in the furtherance of the enterprise”.

VAT will only be levied on “imported services” to the extent

that it will be utilised for the making of non-taxable

supplies. No input VAT will be allowed on the VAT charged

on the importation of services.