Page 46 - P6 Slide Taxation - Lecture Day 3 - VAT Part 1

P. 46

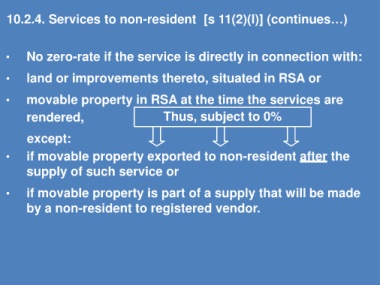

10.2.4. Services to non-resident [s 11(2)(l)] (continues…)

• No zero-rate if the service is directly in connection with:

• land or improvements thereto, situated in RSA or

• movable property in RSA at the time the services are

rendered, Thus, subject to 0%

except:

• if movable property exported to non-resident after the

supply of such service or

• if movable property is part of a supply that will be made

by a non-resident to registered vendor.