Page 14 - Companies & Dividend Tax

P. 14

COMPANIES & CLOSE CORPORATIONS

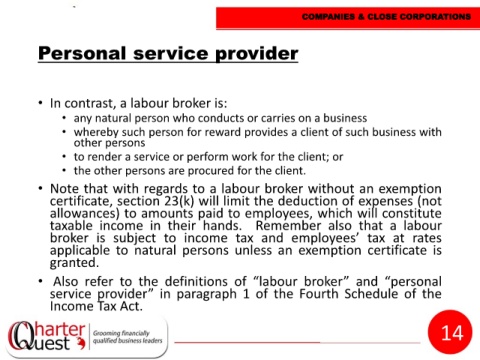

Personal service provider

• In contrast, a labour broker is:

• any natural person who conducts or carries on a business

• whereby such person for reward provides a client of such business with

other persons

• to render a service or perform work for the client; or

• the other persons are procured for the client.

• Note that with regards to a labour broker without an exemption

certificate, section 23(k) will limit the deduction of expenses (not

allowances) to amounts paid to employees, which will constitute

taxable income in their hands. Remember also that a labour

broker is subject to income tax and employees’ tax at rates

applicable to natural persons unless an exemption certificate is

granted.

• Also refer to the definitions of “labour broker” and “personal

service provider” in paragraph 1 of the Fourth Schedule of the

Income Tax Act.

14