Page 8 - Employees tax

P. 8

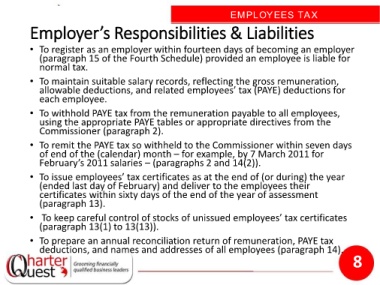

EMPLOYEES TAX

Employer’s Responsibilities & Liabilities

• To register as an employer within fourteen days of becoming an employer

(paragraph 15 of the Fourth Schedule) provided an employee is liable for

normal tax.

• To maintain suitable salary records, reflecting the gross remuneration,

allowable deductions, and related employees’ tax (PAYE) deductions for

each employee.

• To withhold PAYE tax from the remuneration payable to all employees,

using the appropriate PAYE tables or appropriate directives from the

Commissioner (paragraph 2).

• To remit the PAYE tax so withheld to the Commissioner within seven days

of end of the (calendar) month – for example, by 7 March 2011 for

February’s 2011 salaries – (paragraphs 2 and 14(2)).

• To issue employees’ tax certificates as at the end of (or during) the year

(ended last day of February) and deliver to the employees their

certificates within sixty days of the end of the year of assessment

(paragraph 13).

• To keep careful control of stocks of unissued employees’ tax certificates

(paragraph 13(1) to 13(13)).

• To prepare an annual reconciliation return of remuneration, PAYE tax

deductions, and names and addresses of all employees (paragraph 14).

8