Page 10 - FINAL CFA I SLIDES JUNE 2019 DAY 12

P. 10

Session Unit 12:

42. Portfolio Risk and Return: Part II

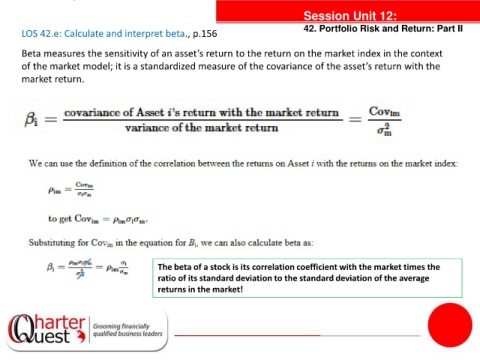

LOS 42.e: Calculate and interpret beta., p.156

Beta measures the sensitivity of an asset’s return to the return on the market index in the context

of the market model; it is a standardized measure of the covariance of the asset’s return with the

market return.

tanties

The beta of a stock is its correlation coefficient with the market times the

ratio of its standard deviation to the standard deviation of the average

returns in the market!