Page 17 - FINAL CFA I SLIDES JUNE 2019 DAY 12

P. 17

Session Unit 12:

42. Portfolio Risk and Return: Part II

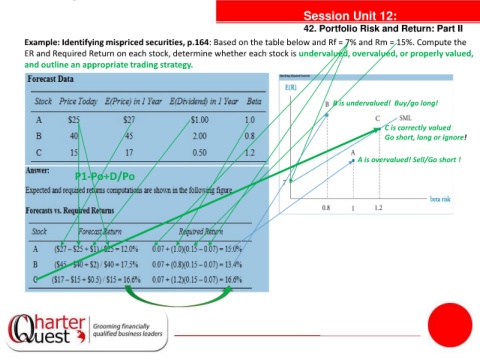

Example: Identifying mispriced securities, p.164: Based on the table below and Rf = 7% and Rm = 15%. Compute the

ER and Required Return on each stock, determine whether each stock is undervalued, overvalued, or properly valued,

and outline an appropriate trading strategy.

B is undervalued! Buy/go long!

C is correctly valued

Go short, long or ignore!

tanties A is overvalued! Sell/Go short !

P1-Po+D/Po