Page 4 - FINAL CFA I SLIDES JUNE 2019 DAY 12

P. 4

LOS 42.b: Explain the Capital Allocation Line Session Unit 12:

(CAL) and the Capital Market Line (CML)., p149 42. Portfolio Risk and Return: Part II

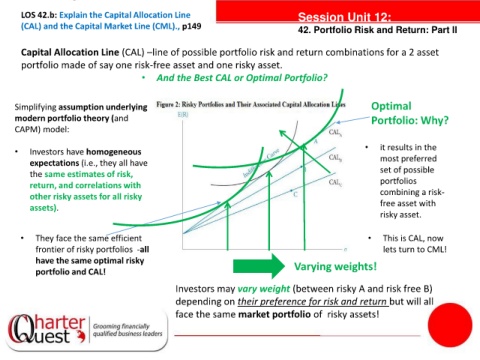

Capital Allocation Line (CAL) –line of possible portfolio risk and return combinations for a 2 asset

portfolio made of say one risk-free asset and one risky asset.

• And the Best CAL or Optimal Portfolio?

Simplifying assumption underlying Optimal

modern portfolio theory (and Portfolio: Why?

CAPM) model:

• Investors have homogeneous tanties • it results in the

expectations (i.e., they all have most preferred

the same estimates of risk, set of possible

return, and correlations with portfolios

combining a risk-

other risky assets for all risky

assets). free asset with

risky asset.

• They face the same efficient • This is CAL, now

frontier of risky portfolios -all lets turn to CML!

have the same optimal risky Varying weights!

portfolio and CAL!

Investors may vary weight (between risky A and risk free B)

depending on their preference for risk and return but will all

face the same market portfolio of risky assets!