Page 112 - P6 Slide Taxation - Lecture Day 7 - Various Topics

P. 112

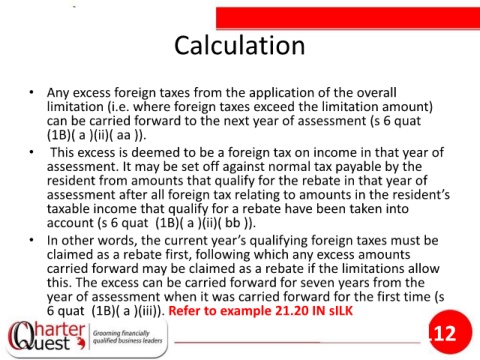

Calculation

• Any excess foreign taxes from the application of the overall

limitation (i.e. where foreign taxes exceed the limitation amount)

can be carried forward to the next year of assessment (s 6 quat

(1B)( a )(ii)( aa )).

• This excess is deemed to be a foreign tax on income in that year of

assessment. It may be set off against normal tax payable by the

resident from amounts that qualify for the rebate in that year of

assessment after all foreign tax relating to amounts in the resident’s

taxable income that qualify for a rebate have been taken into

account (s 6 quat (1B)( a )(ii)( bb )).

• In other words, the current year’s qualifying foreign taxes must be

claimed as a rebate first, following which any excess amounts

carried forward may be claimed as a rebate if the limitations allow

this. The excess can be carried forward for seven years from the

year of assessment when it was carried forward for the first time (s

6 quat (1B)( a )(iii)). Refer to example 21.20 IN sILK

112