Page 35 - P6 Slide Taxation - Lecture Day 7 - Various Topics

P. 35

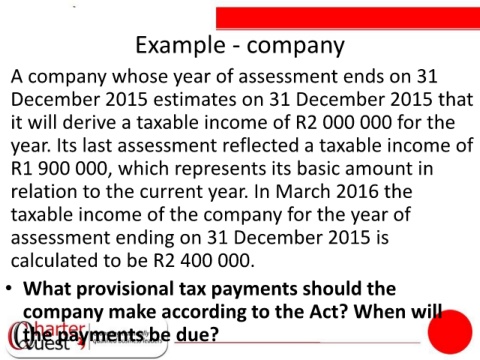

Example - company

A company whose year of assessment ends on 31

December 2015 estimates on 31 December 2015 that

it will derive a taxable income of R2 000 000 for the

year. Its last assessment reflected a taxable income of

R1 900 000, which represents its basic amount in

relation to the current year. In March 2016 the

taxable income of the company for the year of

assessment ending on 31 December 2015 is

calculated to be R2 400 000.

• What provisional tax payments should the

company make according to the Act? When will

the payments be due?