Page 60 - P6 Slide Taxation - Lecture Day 7 - Various Topics

P. 60

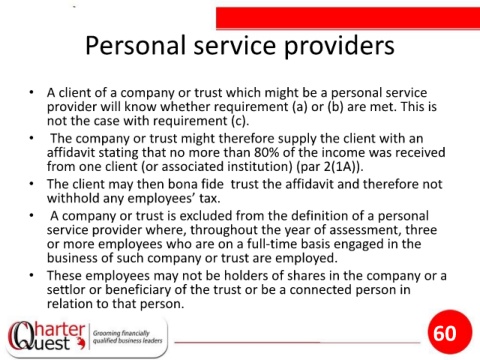

Personal service providers

• A client of a company or trust which might be a personal service

provider will know whether requirement (a) or (b) are met. This is

not the case with requirement (c).

• The company or trust might therefore supply the client with an

affidavit stating that no more than 80% of the income was received

from one client (or associated institution) (par 2(1A)).

• The client may then bona fide trust the affidavit and therefore not

withhold any employees’ tax.

• A company or trust is excluded from the definition of a personal

service provider where, throughout the year of assessment, three

or more employees who are on a full-time basis engaged in the

business of such company or trust are employed.

• These employees may not be holders of shares in the company or a

settlor or beneficiary of the trust or be a connected person in

relation to that person.

60