Page 82 - P6 Slide Taxation - Lecture Day 7 - Various Topics

P. 82

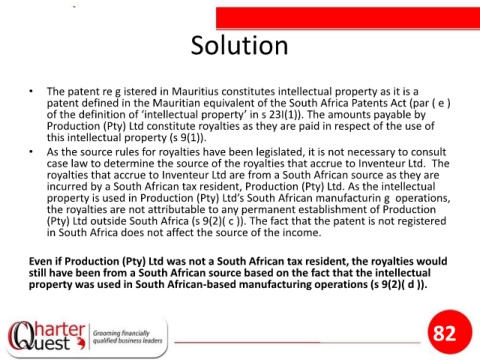

Solution

• The patent re g istered in Mauritius constitutes intellectual property as it is a

patent defined in the Mauritian equivalent of the South Africa Patents Act (par ( e )

of the definition of ‘intellectual property’ in s 23I(1)). The amounts payable by

Production (Pty) Ltd constitute royalties as they are paid in respect of the use of

this intellectual property (s 9(1)).

• As the source rules for royalties have been legislated, it is not necessary to consult

case law to determine the source of the royalties that accrue to Inventeur Ltd. The

royalties that accrue to Inventeur Ltd are from a South African source as they are

incurred by a South African tax resident, Production (Pty) Ltd. As the intellectual

property is used in Production (Pty) Ltd’s South African manufacturin g operations,

the royalties are not attributable to any permanent establishment of Production

(Pty) Ltd outside South Africa (s 9(2)( c )). The fact that the patent is not registered

in South Africa does not affect the source of the income.

Even if Production (Pty) Ltd was not a South African tax resident, the royalties would

still have been from a South African source based on the fact that the intellectual

property was used in South African-based manufacturing operations (s 9(2)( d )).

82