Page 108 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 108

Chapter 9

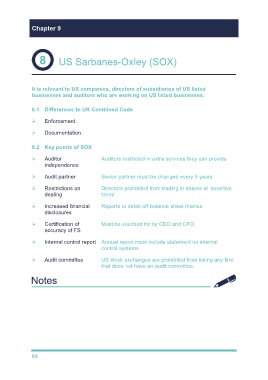

US Sarbanes-Oxley (SOX)

It is relevant to US companies, directors of subsidiaries of US listed

businesses and auditors who are working on US listed businesses.

8.1 Differences to UK Combined Code

Enforcement.

Documentation.

8.2 Key points of SOX

Auditor Auditors restricted in extra services they can provide

independence

Audit partner Senior partner must be changed every 5 years

Restrictions on Directors prohibited from trading in shares at ‘sensitive

dealing times’

Increased financial Reports to detail off-balance sheet finance

disclosures

Certification of Must be vouched for by CEO and CFO

accuracy of FS

Internal control report Annual report must include statement on internal

control systems

Audit committee US stock exchanges are prohibited from listing any firm

that does not have an audit committee.

98