Page 137 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 137

Currency risk management

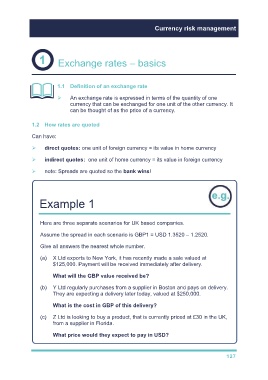

Exchange rates – basics

1.1 Definition of an exchange rate

An exchange rate is expressed in terms of the quantity of one

currency that can be exchanged for one unit of the other currency. It

can be thought of as the price of a currency.

1.2 How rates are quoted

Can have:

direct quotes: one unit of foreign currency = its value in home currency

indirect quotes: one unit of home currency = its value in foreign currency

note: Spreads are quoted so the bank wins!

Example 1

Here are three separate scenarios for UK based companies.

Assume the spread in each scenario is GBP1 = USD 1.3520 – 1.2520.

Give all answers the nearest whole number.

(a) X Ltd exports to New York, it has recently made a sale valued at

$125,000. Payment will be received immediately after delivery.

What will the GBP value received be?

(b) Y Ltd regularly purchases from a supplier in Boston and pays on delivery.

They are expecting a delivery later today, valued at $250,000.

What is the cost in GBP of this delivery?

(c) Z Ltd is looking to buy a product, that is currently priced at £30 in the UK,

from a supplier in Florida.

What price would they expect to pay in USD?

127