Page 145 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 145

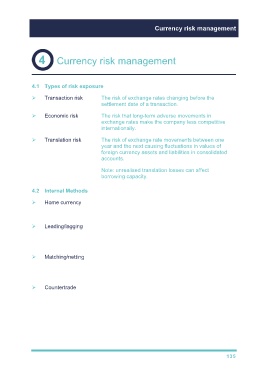

Currency risk management

Currency risk management

4.1 Types of risk exposure

Transaction risk The risk of exchange rates changing before the

settlement date of a transaction.

Economic risk The risk that long-term adverse movements in

exchange rates make the company less competitive

internationally.

Translation risk The risk of exchange rate movements between one

year and the next causing fluctuations in values of

foreign currency assets and liabilities in consolidated

accounts.

Note: unrealised translation losses can affect

borrowing capacity.

4.2 Internal Methods

Home currency Passes risk to other party

Unlikely to be commercially acceptable

Leading/lagging Speed up / delay payment depending on expectations of

exchange rate movement

Problem predicting movements

Matching/netting Match / net off transactions in the same currency

Easier if use foreign bank accounts (risk exposure on net

balance)

Countertrade Avoid using currency and exchange products of equivalent

value

135