Page 266 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 266

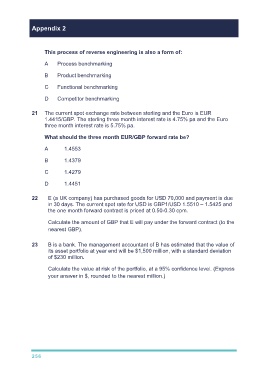

Appendix 2

This process of reverse engineering is also a form of:

A Process benchmarking

B Product benchmarking

C Functional benchmarking

D Competitor benchmarking

21 The current spot exchange rate between sterling and the Euro is EUR

1.4415/GBP. The sterling three month interest rate is 4.75% pa and the Euro

three month interest rate is 5.75% pa.

What should the three month EUR/GBP forward rate be?

A 1.4553

B 1.4379

C 1.4279

D 1.4451

22 E (a UK company) has purchased goods for USD 70,000 and payment is due

in 30 days. The current spot rate for USD is GBP1/USD 1.5510 – 1.5425 and

the one month forward contract is priced at 0.50-0.30 cpm.

Calculate the amount of GBP that E will pay under the forward contract (to the

nearest GBP).

23 B is a bank. The management accountant of B has estimated that the value of

its asset portfolio at year end will be $1,500 million, with a standard deviation

of $230 million.

Calculate the value at risk of the portfolio, at a 95% confidence level. (Express

your answer in $, rounded to the nearest million.)

256