Page 28 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 28

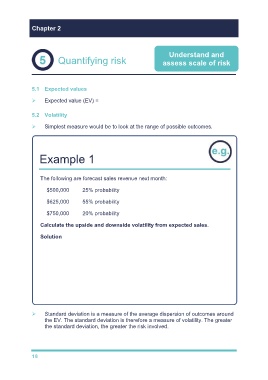

Chapter 2

Understand and

Quantifying risk assess scale of risk

5.1 Expected values

Expected value (EV) = Σ (probability × outcome).

5.2 Volatility

Simplest measure would be to look at the range of possible outcomes.

Example 1

The following are forecast sales revenue next month:

$500,000 25% probability

$625,000 55% probability

$750,000 20% probability

Calculate the upside and downside volatility from expected sales.

Solution

EV = (500,000 × 0.25) + (625,000 × 0.55) + (750,000 × 0.2) = $618,750

The volatility is the possible amount away from the expected value.

The volatility is therefore:

Downside: 618,750 – 500,000 = $118,750

Upside: 750,000 – 618,750 = $131,250

Standard deviation is a measure of the average dispersion of outcomes around

the EV. The standard deviation is therefore a measure of volatility. The greater

the standard deviation, the greater the risk involved.

18