Page 59 - Day 2 - Planning an Audit

P. 59

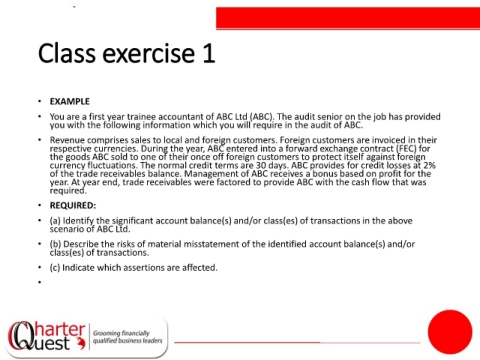

Class exercise 1

• EXAMPLE

• You are a first year trainee accountant of ABC Ltd (ABC). The audit senior on the job has provided

you with the following information which you will require in the audit of ABC.

• Revenue comprises sales to local and foreign customers. Foreign customers are invoiced in their

respective currencies. During the year, ABC entered into a forward exchange contract (FEC) for

the goods ABC sold to one of their once off foreign customers to protect itself against foreign

currency fluctuations. The normal credit terms are 30 days. ABC provides for credit losses at 2%

of the trade receivables balance. Management of ABC receives a bonus based on profit for the

year. At year end, trade receivables were factored to provide ABC with the cash flow that was

required.

• REQUIRED:

• (a) Identify the significant account balance(s) and/or class(es) of transactions in the above

scenario of ABC Ltd.

• (b) Describe the risks of material misstatement of the identified account balance(s) and/or

class(es) of transactions.

• (c) Indicate which assertions are affected.

•