Page 14 - Finac II - Investments in Associates & Joint Ventures

P. 14

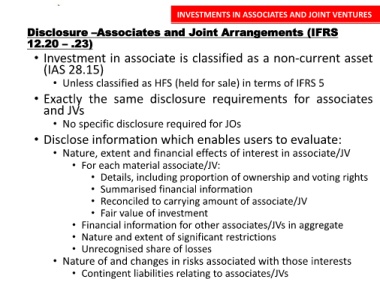

INVESTMENTS IN ASSOCIATES AND JOINT VENTURES

Disclosure –Associates and Joint Arrangements (IFRS

12.20 – .23)

• Investment in associate is classified as a non-current asset

(IAS 28.15)

• Unless classified as HFS (held for sale) in terms of IFRS 5

• Exactly the same disclosure requirements for associates

and JVs

• No specific disclosure required for JOs

• Disclose information which enables users to evaluate:

• Nature, extent and financial effects of interest in associate/JV

• For each material associate/JV:

• Details, including proportion of ownership and voting rights

• Summarised financial information

• Reconciled to carrying amount of associate/JV

• Fair value of investment

• Financial information for other associates/JVs in aggregate

• Nature and extent of significant restrictions

• Unrecognised share of losses

14

• Nature of and changes in risks associated with those interests

• Contingent liabilities relating to associates/JVs