Page 14 - FINAL CFA I SLIDES JUNE 2019 DAY 11

P. 14

Session Unit 11:

38. Working Capital Management

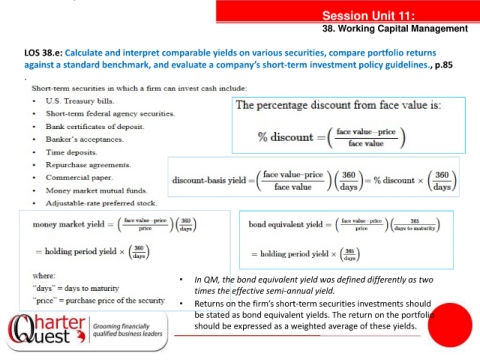

LOS 38.e: Calculate and interpret comparable yields on various securities, compare portfolio returns

against a standard benchmark, and evaluate a company’s short-term investment policy guidelines., p.85

.

tanties

• In QM, the bond equivalent yield was defined differently as two

times the effective semi-annual yield.

• Returns on the firm’s short-term securities investments should

be stated as bond equivalent yields. The return on the portfolio

should be expressed as a weighted average of these yields.