Page 20 - FINAL CFA I SLIDES JUNE 2019 DAY 11

P. 20

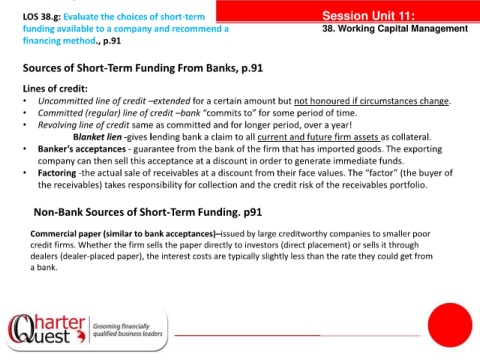

LOS 38.g: Evaluate the choices of short-term Session Unit 11:

funding available to a company and recommend a 38. Working Capital Management

financing method., p.91

Sources of Short-Term Funding From Banks, p.91

Lines of credit:

• Uncommitted line of credit –extended for a certain amount but not honoured if circumstances change.

• Committed (regular) line of credit –bank “commits to” for some period of time.

• Revolving line of credit same as committed and for longer period, over a year!

Blanket lien -gives lending bank a claim to all current and future firm assets as collateral.

tanties

• Banker’s acceptances - guarantee from the bank of the firm that has imported goods. The exporting

company can then sell this acceptance at a discount in order to generate immediate funds.

• Factoring -the actual sale of receivables at a discount from their face values. The “factor” (the buyer of

the receivables) takes responsibility for collection and the credit risk of the receivables portfolio.

Non-Bank Sources of Short-Term Funding. p91

Commercial paper (similar to bank acceptances)–issued by large creditworthy companies to smaller poor

credit firms. Whether the firm sells the paper directly to investors (direct placement) or sells it through

dealers (dealer-placed paper), the interest costs are typically slightly less than the rate they could get from

a bank.