Page 107 - FINAL CFA II SLIDES JUNE 2019 DAY 5.2

P. 107

LOS 19.e: Analyze and interpret how balance sheet modifications, READING 19: INTEGRATION OF FINANCIAL STATEMENT ANALYSIS TECHNIQUES

earnings normalization, and cash flow statement related

modifications affect a company’s financial statements, financial

ratios, and overall financial condition. MODULE 19.5: EARNINGS QUALITY AND CASH FLOW ANALYSIS

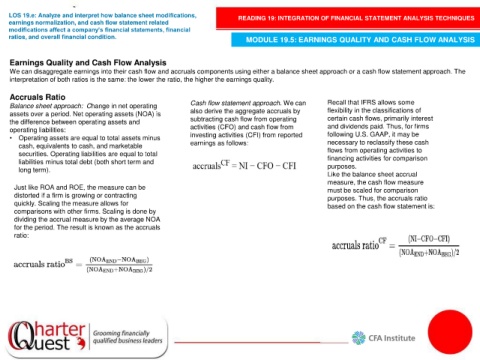

Earnings Quality and Cash Flow Analysis

We can disaggregate earnings into their cash flow and accruals components using either a balance sheet approach or a cash flow statement approach. The

interpretation of both ratios is the same: the lower the ratio, the higher the earnings quality.

Accruals Ratio

Balance sheet approach: Change in net operating Cash flow statement approach. We can Recall that IFRS allows some

assets over a period. Net operating assets (NOA) is also derive the aggregate accruals by flexibility in the classifications of

the difference between operating assets and subtracting cash flow from operating certain cash flows, primarily interest

operating liabilities: activities (CFO) and cash flow from and dividends paid. Thus, for firms

• Operating assets are equal to total assets minus investing activities (CFI) from reported following U.S. GAAP, it may be

cash, equivalents to cash, and marketable earnings as follows: necessary to reclassify these cash

securities. Operating liabilities are equal to total flows from operating activities to

liabilities minus total debt (both short term and financing activities for comparison

long term). purposes.

Like the balance sheet accrual

measure, the cash flow measure

Just like ROA and ROE, the measure can be must be scaled for comparison

distorted if a firm is growing or contracting purposes. Thus, the accruals ratio

quickly. Scaling the measure allows for based on the cash flow statement is:

comparisons with other firms. Scaling is done by

dividing the accrual measure by the average NOA

for the period. The result is known as the accruals

ratio: