Page 67 - FINAL CFA II SLIDES JUNE 2019 DAY 5.2

P. 67

Mixed Balance Sheet/Income Statement Ratios READING 16: MULTINATIONAL OPERATIONS

A mixed ratio combines inputs from both the IS and BS.

The current rate method results in small changes in mixed ratios because the numerator and the denominator MODULE 16.6: RATIOS

are almost always translated at different exchange rates.

Mixed ratios calculated from financial statements translated using the current rate method will be different than the same ratio calculated from the local

currency statements before translation. However, we can’t make any definitive statements about whether specific ratios will be larger or smaller after

translation unless we make the assumption that all mixed ratios are calculated using end-of-period balance sheet figures. The analysis that follows does not

necessarily apply for mixed ratios calculated using beginning or average balance sheet figures.

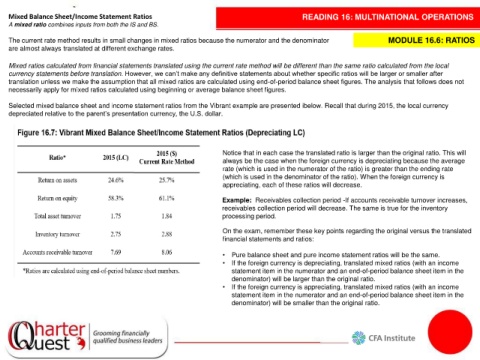

Selected mixed balance sheet and income statement ratios from the Vibrant example are presented ibelow. Recall that during 2015, the local currency

depreciated relative to the parent’s presentation currency, the U.S. dollar.

Notice that in each case the translated ratio is larger than the original ratio. This will

always be the case when the foreign currency is depreciating because the average

rate (which is used in the numerator of the ratio) is greater than the ending rate

(which is used in the denominator of the ratio). When the foreign currency is

appreciating, each of these ratios will decrease.

Example: Receivables collection period -If accounts receivable turnover increases,

receivables collection period will decrease. The same is true for the inventory

processing period.

On the exam, remember these key points regarding the original versus the translated

financial statements and ratios:

• Pure balance sheet and pure income statement ratios will be the same.

• If the foreign currency is depreciating, translated mixed ratios (with an income

statement item in the numerator and an end-of-period balance sheet item in the

denominator) will be larger than the original ratio.

• If the foreign currency is appreciating, translated mixed ratios (with an income

statement item in the numerator and an end-of-period balance sheet item in the

denominator) will be smaller than the original ratio.