Page 85 - FINAL CFA II SLIDES JUNE 2019 DAY 5.2

P. 85

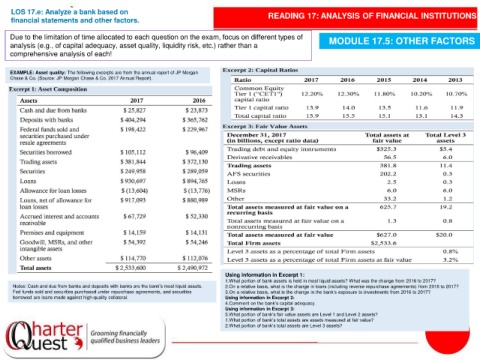

LOS 17.e: Analyze a bank based on

financial statements and other factors. READING 17: ANALYSIS OF FINANCIAL INSTITUTIONS

Due to the limitation of time allocated to each question on the exam, focus on different types of MODULE 17.5: OTHER FACTORS

analysis (e.g., of capital adequacy, asset quality, liquidity risk, etc.) rather than a

comprehensive analysis of each!

EXAMPLE: Asset quality: The following excerpts are from the annual report of JP Morgan

Chase & Co. (Source: JP Morgan Chase & Co. 2017 Annual Report).

Using information in Excerpt 1:

1.What portion of bank assets is held in most liquid assets? What was the change from 2016 to 2017?

Notes: Cash and due from banks and deposits with banks are the bank’s most liquid assets. 2.On a relative basis, what is the change in loans (including reverse repurchase agreements) from 2016 to 2017?

Fed funds sold and securities purchased under repurchase agreements, and securities 3.On a relative basis, what is the change in the bank’s exposure to investments from 2016 to 2017?

borrowed are loans made against high-quality collateral. Using information in Excerpt 2:

4.Comment on the bank’s capital adequacy.

Using information in Excerpt 3:

5.What portion of bank’s fair value assets are Level 1 and Level 2 assets?

1.What portion of bank’s total assets are assets measured at fair value?

2.What portion of bank’s total assets are Level 3 assets?