Page 29 - Chapter 32 VAT Part 3

P. 29

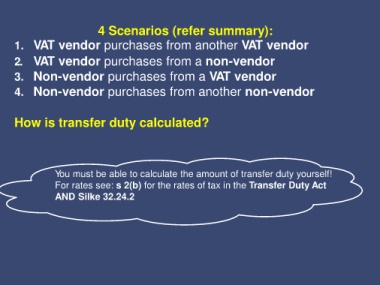

4 Scenarios (refer summary):

1. VAT vendor purchases from another VAT vendor

2. VAT vendor purchases from a non-vendor

3. Non-vendor purchases from a VAT vendor

4. Non-vendor purchases from another non-vendor

How is transfer duty calculated?

You must be able to calculate the amount of transfer duty yourself!

For rates see: s 2(b) for the rates of tax in the Transfer Duty Act

AND Silke 32.24.2