Page 128 - P6 Slide - Taxation - Lecture Day 1

P. 128

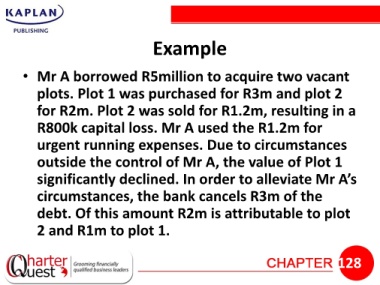

Example

• Mr A borrowed R5million to acquire two vacant

plots. Plot 1 was purchased for R3m and plot 2

for R2m. Plot 2 was sold for R1.2m, resulting in a

R800k capital loss. Mr A used the R1.2m for

urgent running expenses. Due to circumstances

outside the control of Mr A, the value of Plot 1

significantly declined. In order to alleviate Mr A’s

circumstances, the bank cancels R3m of the

debt. Of this amount R2m is attributable to plot

2 and R1m to plot 1.

128