Page 26 - P6 Slide - Taxation - Lecture Day 1

P. 26

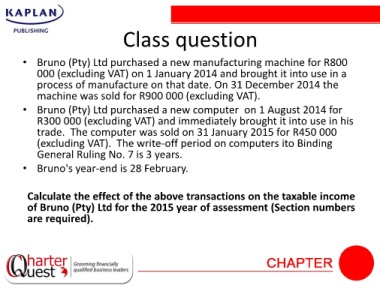

Class question

• Bruno (Pty) Ltd purchased a new manufacturing machine for R800

000 (excluding VAT) on 1 January 2014 and brought it into use in a

process of manufacture on that date. On 31 December 2014 the

machine was sold for R900 000 (excluding VAT).

• Bruno (Pty) Ltd purchased a new computer on 1 August 2014 for

R300 000 (excluding VAT) and immediately brought it into use in his

trade. The computer was sold on 31 January 2015 for R450 000

(excluding VAT). The write-off period on computers ito Binding

General Ruling No. 7 is 3 years.

• Bruno's year-end is 28 February.

Calculate the effect of the above transactions on the taxable income

of Bruno (Pty) Ltd for the 2015 year of assessment (Section numbers

are required).