Page 32 - PowerPoint Presentation

P. 32

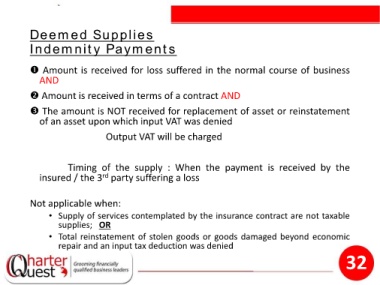

Deemed Supplies

Indemnity Payments

Amount is received for loss suffered in the normal course of business

AND

Amount is received in terms of a contract AND

The amount is NOT received for replacement of asset or reinstatement

of an asset upon which input VAT was denied

Output VAT will be charged

Timing of the supply : When the payment is received by the

insured / the 3 party suffering a loss

rd

Not applicable when:

• Supply of services contemplated by the insurance contract are not taxable

supplies; OR

• Total reinstatement of stolen goods or goods damaged beyond economic

repair and an input tax deduction was denied

32