Page 5 - PowerPoint Presentation

P. 5

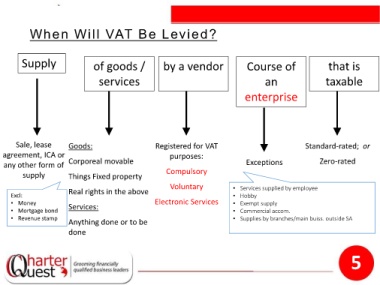

When Will VAT Be Levied?

Supply of goods / by a vendor Course of that is

services an taxable

enterprise

Sale, lease Goods: Registered for VAT Standard-rated; or

agreement, ICA or purposes:

any other form of Corporeal movable Exceptions Zero-rated

supply Things Fixed property Compulsory

Voluntary

Real rights in the above • Services supplied by employee

Excl: • Hobby

• Money Services: Electronic Services • Exempt supply

• Mortgage bond • Commercial accom.

• Revenue stamp • Supplies by branches/main buiss. outside SA

Anything done or to be

done

5