Page 33 - SAICA - Day 3 slides Capital Gains Tax class slides

P. 33

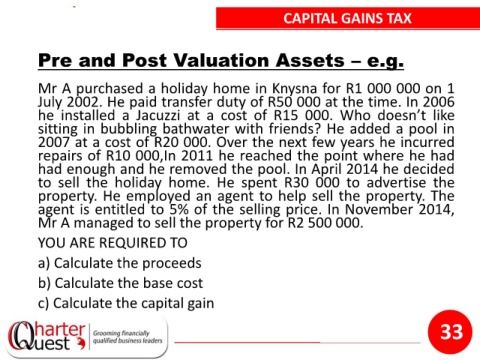

CAPITAL GAINS TAX

Pre and Post Valuation Assets – e.g.

Mr A purchased a holiday home in Knysna for R1 000 000 on 1

July 2002. He paid transfer duty of R50 000 at the time. In 2006

he installed a Jacuzzi at a cost of R15 000. Who doesn’t like

sitting in bubbling bathwater with friends? He added a pool in

2007 at a cost of R20 000. Over the next few years he incurred

repairs of R10 000,In 2011 he reached the point where he had

had enough and he removed the pool. In April 2014 he decided

to sell the holiday home. He spent R30 000 to advertise the

property. He employed an agent to help sell the property. The

agent is entitled to 5% of the selling price. In November 2014,

Mr A managed to sell the property for R2 500 000.

YOU ARE REQUIRED TO

a) Calculate the proceeds

b) Calculate the base cost

c) Calculate the capital gain

33