Page 18 - P6 Slide Taxation - Lecture Day 2 - Trust

P. 18

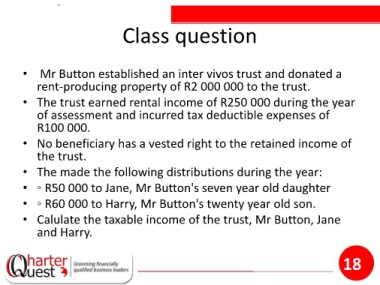

Class question

• Mr Button established an inter vivos trust and donated a

rent-producing property of R2 000 000 to the trust.

• The trust earned rental income of R250 000 during the year

of assessment and incurred tax deductible expenses of

R100 000.

• No beneficiary has a vested right to the retained income of

the trust.

• The made the following distributions during the year:

• ◦ R50 000 to Jane, Mr Button's seven year old daughter

• ◦ R60 000 to Harry, Mr Button's twenty year old son.

• Calulate the taxable income of the trust, Mr Button, Jane

and Harry.

18