Page 8 - FINAL CFA SLIDES DECEMBER 2018 DAY 12

P. 8

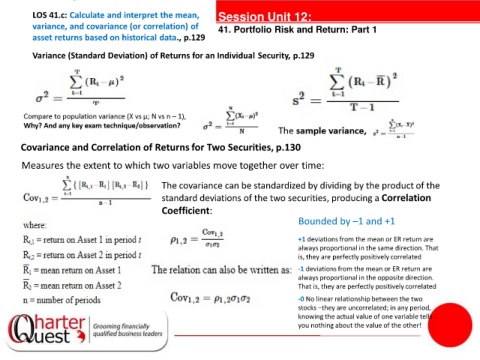

LOS 41.c: Calculate and interpret the mean, Session Unit 12:

variance, and covariance (or correlation) of 41. Portfolio Risk and Return: Part 1

asset returns based on historical data., p.129

Variance (Standard Deviation) of Returns for an Individual Security, p.129

tanties

Covariance and Correlation of Returns for Two Securities, p.130

Measures the extent to which two variables move together over time:

The covariance can be standardized by dividing by the product of the

standard deviations of the two securities, producing a Correlation

Coefficient:

Bounded by –1 and +1

+1 deviations from the mean or ER return are

always proportional in the same direction. That

is, they are perfectly positively correlated

-1 deviations from the mean or ER return are

always proportional in the opposite direction.

That is, they are perfectly positively correlated

-0 No linear relationship between the two

stocks –they are uncorrelated; in any period,

knowing the actual value of one variable tells

you nothing about the value of the other!