Page 26 - PowerPoint Presentation

P. 26

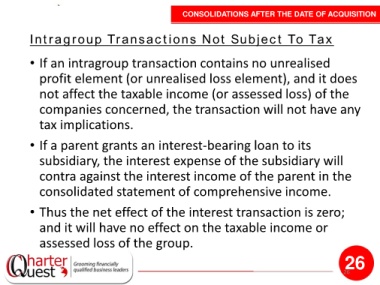

CONSOLIDATIONS AFTER THE DATE OF ACQUISITION

Intragroup Transactions Not Subject To Tax

• If an intragroup transaction contains no unrealised

profit element (or unrealised loss element), and it does

not affect the taxable income (or assessed loss) of the

companies concerned, the transaction will not have any

tax implications.

• If a parent grants an interest-bearing loan to its

subsidiary, the interest expense of the subsidiary will

contra against the interest income of the parent in the

consolidated statement of comprehensive income.

• Thus the net effect of the interest transaction is zero;

and it will have no effect on the taxable income or

assessed loss of the group.

26

26