Page 79 - BA2 Integrated Workbook - Student 2017

P. 79

Marginal and absorption costing

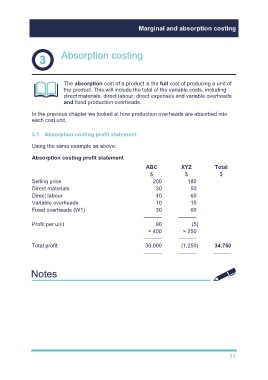

Absorption costing

The absorption cost of a product is the full cost of producing a unit of

the product. This will include the total of the variable costs, including

direct materials, direct labour, direct expenses and variable overheads

and fixed production overheads.

In the previous chapter we looked at how production overheads are absorbed into

each cost unit.

3.1 Absorption costing profit statement

Using the same example as above:

Absorption costing profit statement

ABC XYZ Total

$ $ $

Selling price 200 180

Direct materials 30 50

Direct labour 40 60

Variable overheads 10 15

Fixed overheads (W1) 30 60

–––––– ––––––

Profit per unit 90 (5)

× 400 × 250

–––––– ––––––

Total profit 36,000 (1,250) 34,750

–––––– –––––– ––––––

71