Page 14 - FINAL CFA I SLIDES JUNE 2019 DAY 2

P. 14

LOS 6.e: Calculate and interpret the FV & PV Session Unit 2: The Time Value of Money

of a single sum of money, an ordinary annuity,

an annuity due, a perpetuity (PV only), and a

series of unequal cash flows.

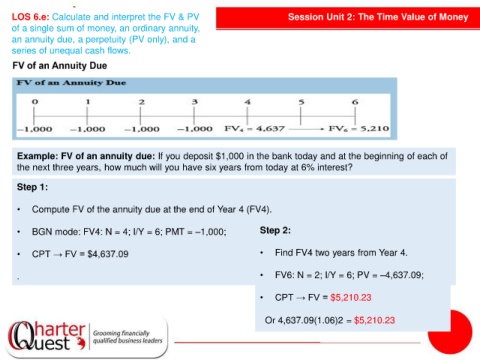

Example: FV of an annuity due: If you deposit $1,000 in the bank today and at the beginning of each of

the next three years, how much will you have six years from today at 6% interest?

Step 1:

• Compute FV of the annuity due at the end of Year 4 (FV4).

• BGN mode: FV4: N = 4; I/Y = 6; PMT = –1,000; Step 2:

• CPT → FV = $4,637.09 • Find FV4 two years from Year 4.

. • FV6: N = 2; I/Y = 6; PV = –4,637.09;

• CPT → FV = $5,210.23

Or 4,637.09(1.06)2 = $5,210.23