Page 20 - FINAL CFA I SLIDES JUNE 2019 DAY 2

P. 20

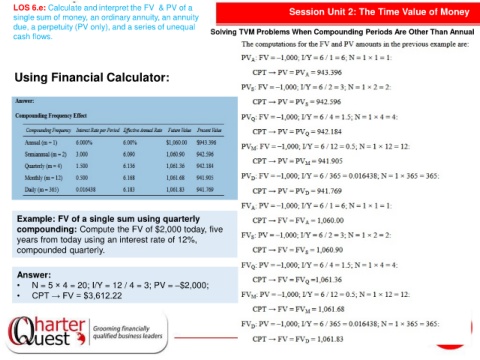

LOS 6.e: Calculate and interpret the FV & PV of a Session Unit 2: The Time Value of Money

single sum of money, an ordinary annuity, an annuity

due, a perpetuity (PV only), and a series of unequal Solving TVM Problems When Compounding Periods Are Other Than Annual

cash flows.

Using Financial Calculator:

Example: FV of a single sum using quarterly

compounding: Compute the FV of $2,000 today, five

years from today using an interest rate of 12%,

compounded quarterly.

Answer:

• N = 5 × 4 = 20; I/Y = 12 / 4 = 3; PV = –$2,000;

• CPT → FV = $3,612.22