Page 12 - FINAL CFA SLIDES DECEMBER 2018 DAY 4

P. 12

Session Unit 2:

8. Statistical Concepts and Market Returns

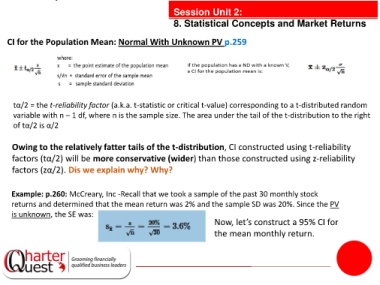

CI for the Population Mean: Normal With Unknown PV p.259

tα/2 = the t-reliability factor (a.k.a. t-statistic or critical t-value) corresponding to a t-distributed random

variable with n – 1 df, where n is the sample size. The area under the tail of the t-distribution to the right

of tα/2 is α/2

Owing to the relatively fatter tails of the t-distribution, CI constructed using t-reliability

factors (tα/2) will be more conservative (wider) than those constructed using z-reliability

factors (zα/2). Dis we explain why? Why?

Example: p.260: McCreary, Inc -Recall that we took a sample of the past 30 monthly stock

returns and determined that the mean return was 2% and the sample SD was 20%. Since the PV

is unknown, the SE was:

Now, let’s construct a 95% CI for

the mean monthly return.