Page 31 - FINAL CFA SLIDES DECEMBER 2018 DAY 4

P. 31

Session Unit 3:

12. Hypothesis Testing

LOS 12.e: Distinguish between a statistical result and an economically meaningful result, p283

Statistically significant result Economically significance considerations!

Say you reject Ho and hence support Ha • Transaction costs

that 20 year returns to a strategy are +ve. • Taxes

• Risk

Do you execute the strategy?

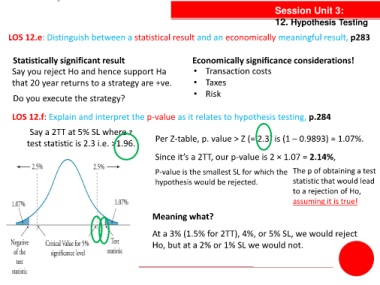

LOS 12.f: Explain and interpret the p-value as it relates to hypothesis testing, p.284

Say a 2TT at 5% SL where z

test statistic is 2.3 i.e. >1.96. Per Z-table, p. value > Z (= 2.3) is (1 – 0.9893) = 1.07%.

Since it’s a 2TT, our p-value is 2 × 1.07 = 2.14%,

P-value is the smallest SL for which the The p of obtaining a test

hypothesis would be rejected. statistic that would lead

to a rejection of Ho,

assuming it is true!

Meaning what?

At a 3% (1.5% for 2TT), 4%, or 5% SL, we would reject

Ho, but at a 2% or 1% SL we would not.