Page 51 - CFA Lecture Day 8 Slides

P. 51

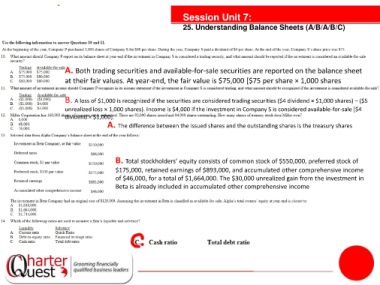

Session Unit 7:

25. Understanding Balance Sheets (A/B/A/B/C)

A. Both trading securities and available-for-sale securities are reported on the balance sheet

at their fair values. At year-end, the fair value is $75,000 [$75 per share × 1,000 shares

B. A loss of $1,000 is recognized if the securities are considered trading securities ($4 dividend × $1,000 shares) – ($5

unrealized loss × 1,000 shares). Income is $4,000 if the investment in Company S is considered available-for-sale [$4

tanties

dividend × $1,000].

A. The difference between the issued shares and the outstanding shares is the treasury shares

B. Total stockholders’ equity consists of common stock of $550,000, preferred stock of

$175,000, retained earnings of $893,000, and accumulated other comprehensive income

of $46,000, for a total of $1,664,000. The $30,000 unrealized gain from the investment in

Beta is already included in accumulated other comprehensive income