Page 116 - BA1 Integrated Workbook STUDENT 2018

P. 116

Chapter 7

Net Present Value

5.1 Introduction

The Net Present Value (NPV) is the net benefit or loss of benefit, in

present value terms, from an investment opportunity. It represents the

surplus funds (after funding the investment) earned on the project, and

calculates the impact on shareholders’ wealth.

5.2 Decision Criteria

A project with a positive NPV is viable.

A project with a negative NPV is not viable.

Faced with mutually-exclusive projects, choose the project with

the highest NPV.

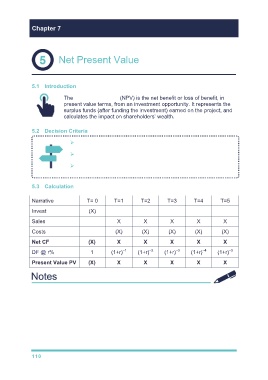

5.3 Calculation

Narrative T= 0 T=1 T=2 T=3 T=4 T=5

Invest (X)

Sales X X X X X

Costs (X) (X) (X) (X) (X)

Net CF (X) X X X X X

–5

DF @ r% 1 (1+r) –1 (1+r) –2 (1+r) –3 (1+r) –4 (1+r)

Present Value PV (X) X X X X X

110