Page 129 - SBR Integrated Workbook STUDENT S18-J19

P. 129

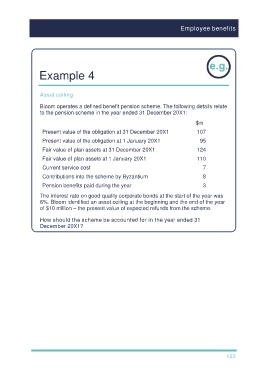

Employee benefits

Example 4

Asset ceiling

Bloom operates a defined benefit pension scheme. The following details relate

to the pension scheme in the year ended 31 December 20X1:

$m

Present value of the obligation at 31 December 20X1 107

Present value of the obligation at 1 January 20X1 95

Fair value of plan assets at 31 December 20X1 124

Fair value of plan assets at 1 January 20X1 110

Current service cost 7

Contributions into the scheme by Byzantium 8

Pension benefits paid during the year 3

The interest rate on good quality corporate bonds at the start of the year was

6%. Bloom identified an asset ceiling at the beginning and the end of the year

of $10 million – the present value of expected refunds from the scheme.

How should the scheme be accounted for in the year ended 31

December 20X1?

123